Having a budget is an important way to keep track of your finances. Without a budget, it can be easy to watch the money come and go from your account without having a good understanding of exactly how it’s being spent. If you want to put yourself in charge of your money, check out these tips for how to live on a budget and successfully manage your funds.

Why Is a Budget Important?

Having a budget gives you control over how you spend your cash. We’ve all experienced how easy it is to swipe your credit card and move on with life. The surprise comes when you look at your credit card balance or bank account and wonder where your funds went.

Having a budget is simply a way to allocate where it’s all going and put yourself in the driver’s seat when it comes to allocating funds.

Budgeting Methods

While some people find it easiest to create a detailed budget, with categories for every expenditure or group of expenses (i.e. groceries, gas, etc.), others prefer more of an overview method of tracking account balances and setting up alerts if certain levels are hit.

The way you budget all depends on how strict you feel you need to be with your resources. If there’s a spending issue or cash it tight, it’s all the more important to buckle down on your budget. This may mean creating categories for each of your expenses, budgeting every month, and keeping a tight rein on what you purchase.

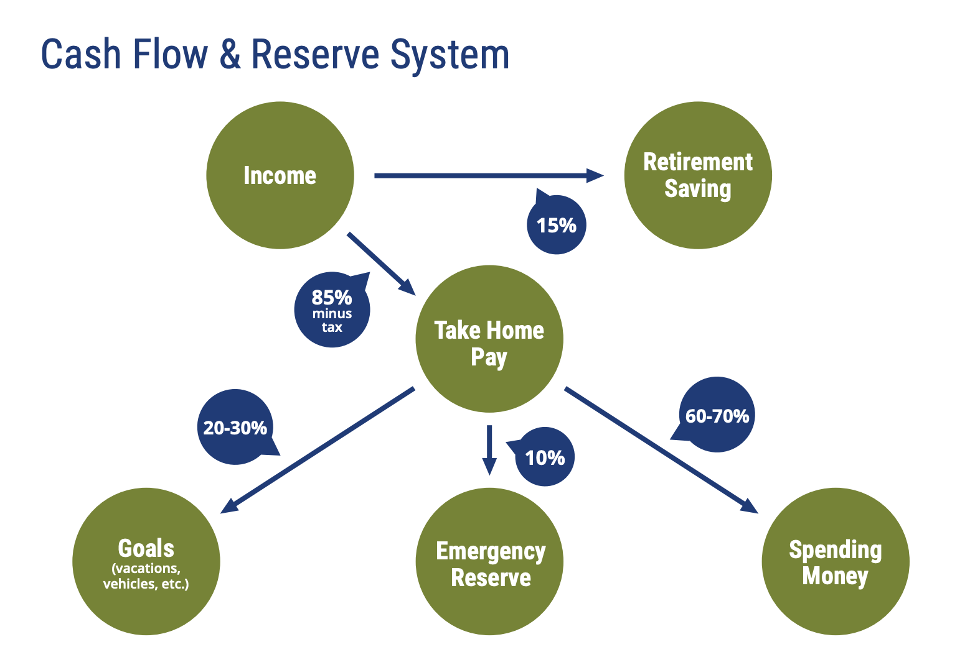

Regardless of the exact methods you use to budget, our cash flow map is the basic system that we recommend when it comes to allocating your funds.

How to Live on a Budget – 6 Tips for Success

1. Budget every month

Firstly, for those who choose a more detailed budgeting system, sitting down each month to take a look at your funds is a good way to stay on top of where each dollar is going. Each month, take stock of your income and upcoming expenses, and assign your monetary resources to these expenses. Once the cash for each category is gone, it’s time to stop spending!

2. Cut your expenses where possible

Next, if you find that you don’t have enough to pay for all of your monthly needs, such as consumables, your rent or mortgage, transportation, utilities, health care, subscriptions, etc., you either need to increase your income or figure out how to cut your expenses. Remember, YOU are in control of your budget. Sometimes, making it work is all about decisions. Take a close look at the categories of your expenses and figure out what you can reduce and what you can’t. Sometimes, working toward your monetary goals means cutting out expenses that fun but not actually necessary. It’s all about choices!

3. Use your credit card wisely

Credit cards can be helpful and convenient, but they can also get you in trouble. They’re helpful for building your credit score (when used appropriately), and are also more secure than using a debit card. Sometimes, you may even be able to receive monetary rewards.

On the other hand, credit cards can also have negative affects when they’re not used with caution. For example, if you’re late on your payments, this can negatively impact your credit score. In addition, the ease of swiping your card can also lead to overspending.

Setting a credit limit is one way to ensure that you don’t overspend.

If you do want to use a credit card, be sure to use it wisely by making payments on time. In addition, make sure to only charge the card if you have the cash in your account to pay for it. Check out these additional tips for using your credit card wisely!

4. Make sure you have an emergency fund

Having an emergency fund is vital for being able to stick to your budget when unexpected incidents arise. Whether you run into car trouble, get laid off, or have a medical emergency, an emergency fund allows you to be prepared for life’s unforeseeable challenges.

If an emergency happens and you don’t have funds set aside, your budget will almost certainly suffer.

5. Remember your “why”

Having your financial goals in the forefront of your mind is one of the most important aspects of being able to stick to your budget! Without knowing why you’re doing what you’re doing, the motivation just won’t be there.

Do you want to be prepared for a comfortable retirement? Hope to pay off your home soon? Want to begin investing for your kids? No matter what your personal financial milestones are, reviewing and remembering them on a regular basis will give you the fuel you need to stick to your budget.

6. Talk to your financial advisor about your goals

A financial advisor can give you a birds eye view of what it takes to meet your financial goals. Having an outside perspective on your cash flow and investments can help you to keep a level head when you’re tempted to make quick decisions about your money.

We’d Be Honored to Help You Meet Your Financial Goals

Have questions about your budget or how to meet your own financial goals? We’d love to talk. Our passion is helping people meet their financial milestones with a plan that works for you. Ready to get started? Schedule a meeting today!

This material is not intended to replace the advice of a qualified tax advisor, attorney, or accountant. Consultation with the appropriate professional should be done before any financial commitments regarding the issues related to the situations above are made.