So, you got your paycheck. What’s next? How can you allocate the money properly so that you have enough for each aspect of your life? You need to be prepared for retirement, be ready for emergencies, work toward your goals (such as vacations, vehicles, etc.), and have enough left over for spending money. Here’s how we recommend splitting up your cash flow so that you can be adequately prepared for each of these aspects of life.

Categories of the cash flow & reserve system

At Milestone, our goal is to make sure that you’re prepared for the financial milestones that you want to reach. In order to achieve this, we recommend having a solid plan for where your income is going each time you bring a paycheck home.

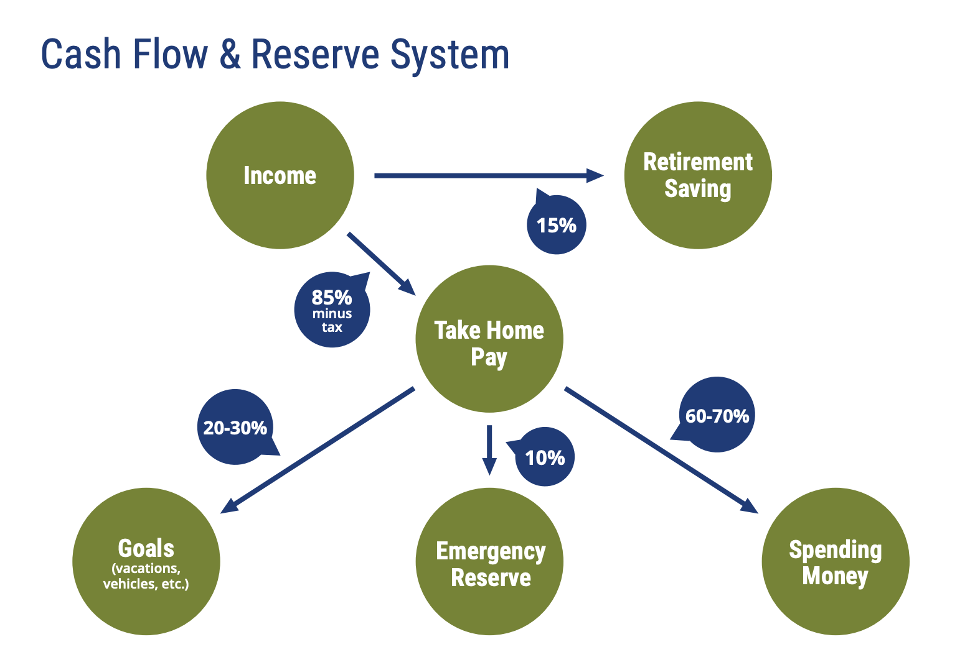

The categories that your income should be flowing into include retirement savings and take home pay. Take home pay is then broken down into your goals, your emergency reserve (or emergency fund), and your spending money.

This helpful chart is a visual representation of the percentages that we recommend putting into each category.

Retirement saving

The first category is retirement savings. This category should be 15% of your gross income. In most cases, if you invest this amount throughout your working years, you should be adequately prepared to replace your paycheck when your retirement years arrive.

However, if you are getting started on retirement savings later in life, you may need to invest more than 15%.

Take home pay

After you set aside your retirement savings, the rest of your income (85% minus tax) is your take home pay. This amount should be split up into three categories: goals, emergency reserve, and spending money.

Goals

This category accounts for items that are irregular or special expenses. These are non-monthly, consumable expenses, such as a new car, a vacation, new couches, etc.

We suggest setting aside 20-30% of your take-home pay for these goals. If there’s a deadline (for example, you want to take a vacation in November), that will help you identify what end of the 20-30% you need to be setting aside.

Learn more about how to save for these irregular expenses in this post!

Emergency reserve

Next is your emergency reserve, which is often called an emergency fund. 10% of your income should be going toward this category.

Your emergency fund is a fully liquid account that should be able to cover 6 months of expenses. The actual dollar amount that you should have in your fund will depend on you, your family, and your monthly financial needs. Because no one knows when an emergency will arise, this fund assures that you’ll be prepared for financial troubles such as unplanned medical bills, job loss, car trouble, or other unforeseen events, without having to rely on a credit card or incur other debt.

We recommend setting up your emergency reserve as a savings account that’s attached to a checking account, where the money is funneled through.

Once you’ve reached the goal of having 6 months of expenses covered, you can start a second emergency reserve in a taxable investment account. This will allow you to have higher growth potential.

Spending money

Lastly is the category of spending money. This is the amount that’s left over after you’ve assigned money to your retirement saving, goals, and emergency reserve. It should be 60-70% of your take-home pay.

Your spending money covers all of your regular monthly expenses, such as utilities, groceries, insurance premiums, your rent/mortgage payment, clothing, and entertainment.

If the 60-70% left over isn’t enough to cover these monthly expenses, it’s time to sit down and take a close look at how you can slash some of your expenses. Additionally, you may also be able to find ways to increase your income, whether by working toward advancing in your career or picking up a side job.

Read more about how to budget for financial success and allocate your cash.

We’re here to help you prepare for a successful future

If you have questions about how to set up your cash flow & reserve system, we’re here to help. For many people who are working on allocating funds, the process brings up lots of questions.

How much do I need for retirement? Is 15% enough? How should I set up my emergency fund? What goals fit into my overall financial objectives?

No matter what questions you’re asking about your cash flow, we’re here to help. We’d love to sit down with you and talk about your financial goals and how you can achieve them. Book a meeting today!

This material is not intended to replace the advice of a qualified tax advisor, attorney, or accountant. Consultation with the appropriate professional should be done before any financial commitments regarding the issues related to the situations above are made.