A will versus a living trust — what’s the difference?

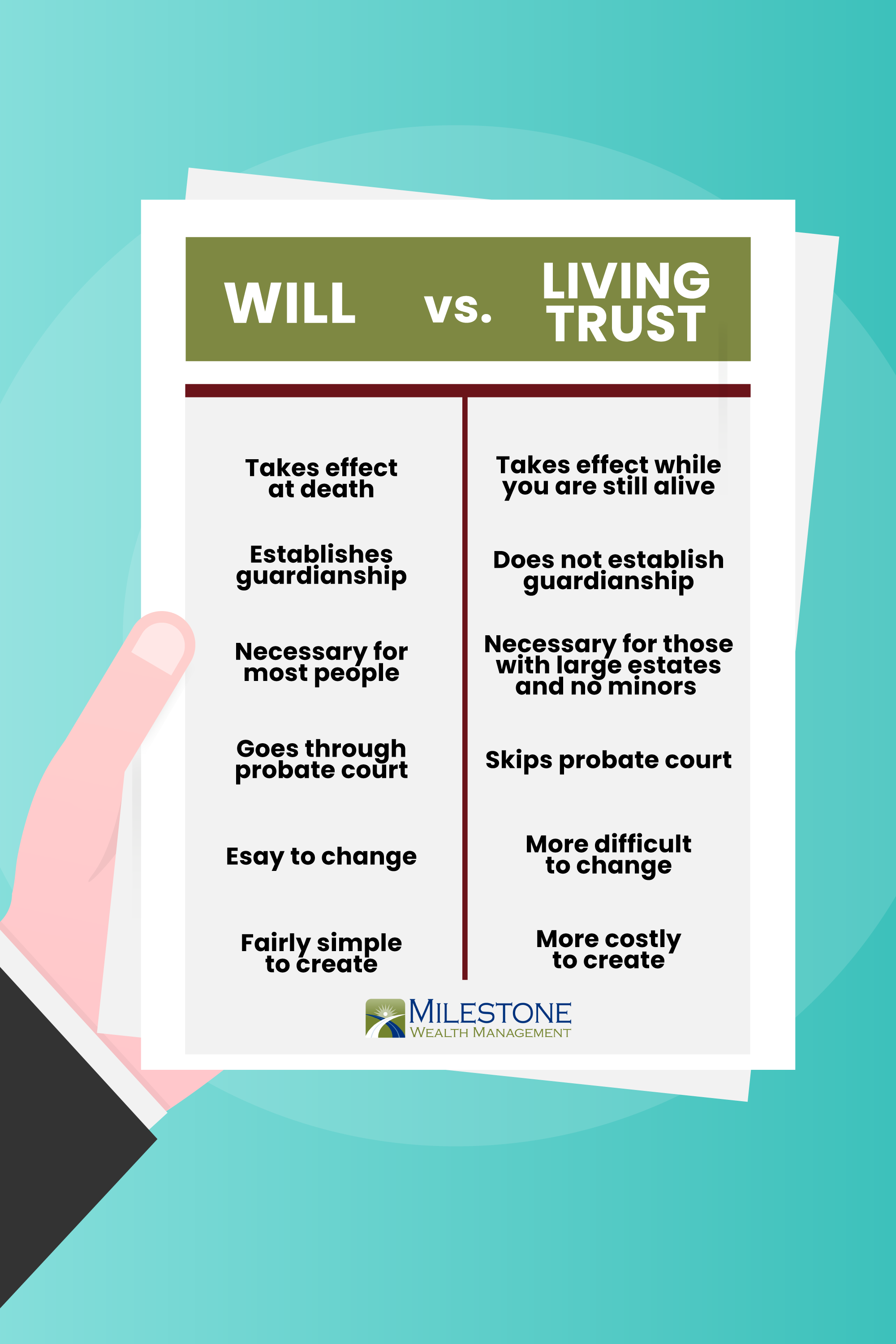

What’s the difference between a will and a living trust? In this post, we’re going to examine each option, and discuss which might be the best fit for your situation. Both a will and a living trust are legal tools that allow you to make your wishes known. While they are similar in more general ways, you will see that they also have many differences.

Estate planning is a very important step in your journey of protecting your children and your finances. It will also significantly lighten the load for your loved ones when the time comes for them to carry out your wishes.

What is a will?

A will is a legal document that gives instructions for how you want your assets distributed if and when something happens to you. This can include what happens to your finances, home, children, pets, and even your funeral wishes. A will becomes active only after your death, whereas a trust becomes active as soon as it is created.

Wills must go through a probate judge, who ensures that the will is valid and legal. Thankfully, probate court is usually not a big deal if you have a will. Without a will, however, probate court can be long and expensive, especially if litigation becomes necessary.

A will simplifies and streamlines the decision-making process for your family, since your desires are well-established and recognized by the court. On the other hand, not having a will can cause difficulty and strife among family and loved ones, who may each have their own ideas of your wishes.

A will can be created by an attorney, or, in many cases, can simply be created online. Most people only require a will. However, if you have at least $1 million in assets, you may require a living trust. Read on to find out what a living trust entails.

What is a living trust?

A living trust is a legal entity that protects your assets. Whereas a will goes into effect after your death, a living trust goes into effect while you’re still alive. After you create your living trust, you will fund it with things like bank or savings accounts, vehicles, real estate, possessions (such as jewelry or other costly items), and even intellectual property.

There are two kinds of trusts—revocable and irrevocable. A revocable trust simply means that it can be changed. Irrevocable trusts cannot be changed. Conveniently, all revocable trusts automatically switch to irrevocable upon the owner’s death.

A major benefit to living trusts is that they skip probate court altogether. This means that your family doesn’t have to worry about spending time going back and forth to court while also trying to grieve.

Living trusts, unlike wills, do not establish guardianship for children or pets. That means that if you have children under your care, it’s very important that you get a will. You may find that it is necessary in your situation to have both a will and a trust. The other downside to living trusts is that they generally cost upwards of $5,000 to create, whereas a will only costs a few hundred.

Which should you choose?

As we’ve established, there are many differences as well as some similarities between a will and a living trust. Now that we’ve discussed the options, should you get a will, a living trust, or both?

Take a good look at your circumstances, assets, and needs.

Consider a will if you have young children, a house, and less than $1 million in assets. You can get your will set up with a lawyer, or, unless you have an especially complicated situation, you can even go through the process online.

Consider a trust if you are older, your children are grown, and you have over $1 million in assets. A trust will allow your family to skip probate court if something happens to you.

Consider both a will and a trust if you have minor children AND have a large estate. Remember that a will is vital to ensuring proper guardianship for your children.

Is estate planning actually important?

It can feel strange to think about the future, especially if it seems far off. But remember, one of the most loving things that you can do for your family is to prepare your wishes and get your financial house in order ahead of time. Having your will or living trust established will make life much simpler for your loved ones if something happens to you – and eventually, it will.

Milestone Wealth Management exists to help you ensure that your financial future is secure. We would be honored to talk with you about the future of your family and estate, and help you make the best decision for your situation. Contact us today, and let’s start creating a plan that will give you confidence for the years ahead.

This material is not intended to replace the advice of a qualified tax advisor, attorney, or accountant. Consultation with the appropriate professional should be done before any financial commitments regarding the issues related to the situations above are made.