At Milestone Wealth Management, we recommend a 3-tier cash reserve system to provide the best safety net for your family and your investments – both in the short term and long term. Taking an honest look at your current cash reserves is an excellent way to prepare yourself to reach your financial milestones.

What is a cash reserve system?

A cash reserve system refers to money that is kept on hand for short-term and/or long-term needs. A cash reserve system is an important step in being prepared for the future – both immediate and down the road. It can include both highly accessible, day-to-day cashflow and less accessible cashflow (such as investment accounts).

How does Milestone Wealth Management view cash reserve systems?

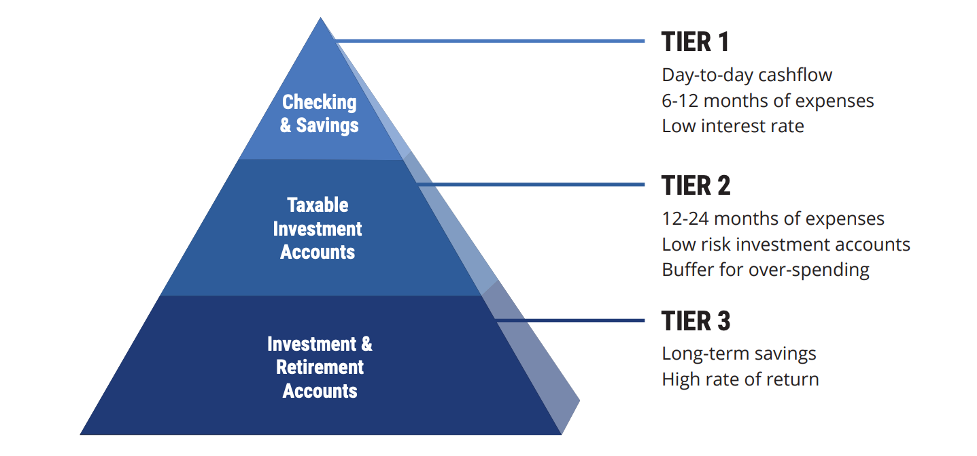

At Milestone, we recommend a 3-tier cash reserve system. The 3-tiers provide financial safety for you and your family from tomorrow all the way into your retirement years.

Tier 1 includes checking and savings, and it takes care of day-to-day cashflow. Tier 2 is made up of taxable investment accounts and often acts as a buffer. Lastly, tier 3 is long-term savings, such as investment and retirement accounts. Keep reading to learn more about how each of the tiers work.

Here at Milestone, we want you to be prepared for both the immediate future and the long-term. This is why we believe it’s important to have multiple, intentional tiers in your cash reserve system.

Why should you have a cash reserve system?

A cash reserve system is a way of thinking about your finances that allows you to meet both your short-term needs and longer-term goals. By separating your money into different levels of risk, matched to the time-use of money, you minimize the chance of having to tap into a specific investment at a poor time.

In this way, a 3-tier cash reserve system works very effectively to receive the most investment from your hard-earned cash.

The 3 tiers

Let’s take a closer look at the 3 tiers of a cash reserve system and how they work.

Tier 1

This is your day-to-day cashflow. Tier 1 is convenient and liquid. It generally accounts for about 6-12 months of expenses. However, with tier 1 cashflow, the interest rate is low.

Tier 2

The excess of your tier 1 cashflow will spill into tier 2. These funds are generally enough to last for 12-24 months. Tier 2 is made up of your lower-risk investment accounts. It can be anything from municipal bonds to dividend-paying stocks. Tier 2 is slightly less accessible and therefore acts as a buffer for overspending.

Tier 3

Last up is tier 3 – long-term savings. This generally includes retirement savings and tax-advantaged accounts. The focus of tier 3 is a high rate of return long term. The goal of tier 3 is generally to remain untouched and to avoid the risk of needing to pull money out at an inopportune time, such as right after a market decline.

How are your cash reserves?

Have you considered a 3-tier system for your cash reserves? What questions do you have about creating a safe financial future through a cash reserve system?

No matter your position, Milestone Wealth Management is here to help. We’d love to sit down with you and make a plan to help you meet your financial milestones. Book a meeting today!

This material is not intended to replace the advice of a qualified tax advisor, attorney, or accountant. Consultation with the appropriate professional should be done before any financial commitments regarding the issues related to the situations above are made.