Why budget?

Although the word “budget” may sound restricting and scary, a budget is actually a crucial step on your path to financial freedom. A budget makes your money work for you and helps you meet your financial goals. It assigns your money to your specific expenses, allowing you to use your money responsibly and to know where your hard-earned cash is going.

A budget is made by adding up all of the money you bring home, listing out all of your expenses, and assigning your money accordingly. There are a few different methods to budgeting, including the 50-30-20 method and a zero-based budget.

First steps

The first step to making your budget is assessing your income and expenses. When your budget is completed, your income and expenses should be equal.

First, account for all of your take-home income. Remember, this is the amount you take home, after taxes, deductions for 401(K), and any other amounts that are subtracted from your paycheck. Be sure to include any extra income, such as side jobs, child support, alimony, etc.

Next, you’ll need to track down your monthly expenses. You will likely need to gather some bills and receipts from the past month or two in order to get accurate numbers. Take into account fixed expenses (such as mortgage or rent, car payment, and phone service) and variable expenses (such as groceries, clothing, and gas).

Plug in the numbers

After your information is gathered, you’re ready to start plugging in your numbers. You’ll need to decide what type of budget you’re going to use. A zero-based budget and a 50-30-20 budget are the primary options.

Zero-based budget: With this method, inflow minus outflow = $0. A zero-based budget assigns a job to every dollar you make. It’s more hands-on than the 50-30-20 method and requires keeping a close track of the money you spend. A zero-based budget is excellent if you have never budgeted before or have very specific financial goals. It keeps you accountable for every single dollar and helps avoid overspending.

50-30-20 budget: This type of budget is a lot more flexible, and is best for people who have more income than expenses. A 50-30-20 budget allocates 50% toward necessities, such as rent, food, and debt payments, 30% toward wants, such as eating out and entertainment, and 20% toward savings.

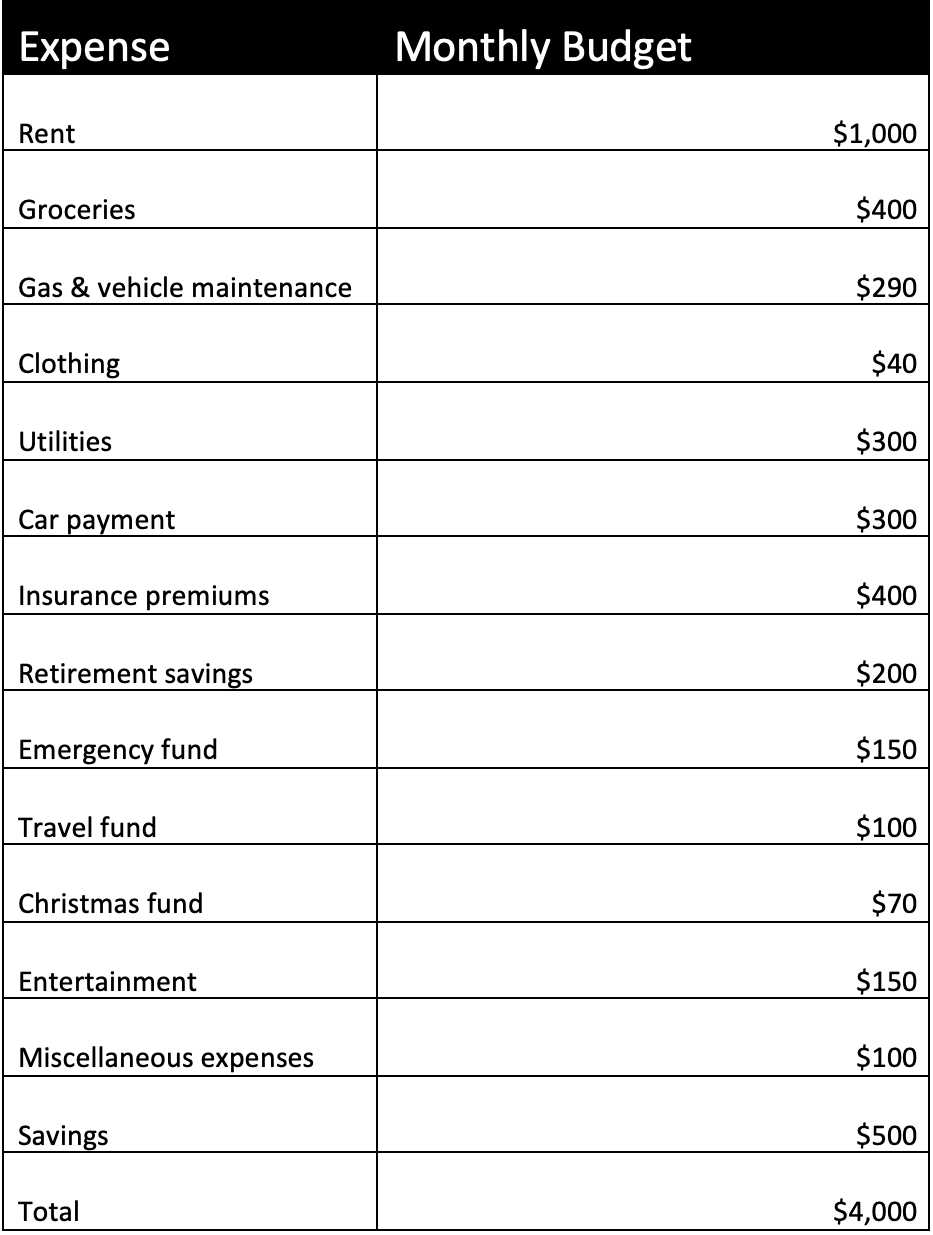

Below is a sample budget for a person who brings home $4,000 per month. Depending on your expenses and lifestyle, you will likely need to add or take away some columns from this sample.

When it comes to making your budget, you’ll have to decide the best way for you to stay organized. You can make your budget with pen and paper, create an Excel spreadsheet, or use a budgeting app. Some of the most popular apps include Mint, You Need a Budget, Goodbudget, and PocketGuard.

Tips and tricks

As you may have noticed, our sample budget included some extra categories, such as “Christmas fund” and “travel fund”. As you’re allocating for your monthly expenses, it’s important to save money for those expenses that are less regular. If you are planning for a vacation or hoping to purchase a new couch, simply take the amount you will need, divide it by the number of months until the purchase, and start saving! You will be so relieved that when the time comes, the money is already set aside and ready to go.

Other important categories that you may have noticed include an “emergency fund” and “miscellaneous expenses”. An emergency fund offers security in case of an unexpected circumstance, such as an injury, job loss, or major vehicle problem. As a good rule of thumb, aim to have three to six months’ worth of expenses saved in your emergency fund. A “miscellaneous expenses” fund is helpful for those smaller, monthly expenses that may differ from normal months, such as a higher grocery bill or replacing the pillow that your dog chewed up.

If you are married or have a life partner, be sure to create your budget together! Budgeting will only work if both of you are on board, so be sure to communicate about the columns that you will need and how you will stick to them together.

If you try out your budget for a month or two and find that your expenses are exceeding your income, you’ll need to make some changes by either decreasing your spending or increasing your income. In order to achieve your financial goals, you may need to cancel your cable television or cook more meals at home. Alternatively, you could opt to pick up a side job and increase your income.

We’d love to help!

We hope that these tips are helpful for you as you work to achieve your financial goals. At Milestone Wealth Management, we want you to feel confident in every aspect of your financial life. We’re here to help you achieve your goals and plan for your future. Reach out to us today, and let us help you get your financial future on track.